Critical Questions about Patient Care in Cryonics and Biostasis

How do the organizations compare?

Part of the mission of Biostasis Technologies is to research and recommend best practices for all biostasis organizations. When making arrangements for cryonics or biostasis, two core capabilities should be forefront in your mind. The first is on organization’s capability in getting you preserved quickly and effectively. That includes response readiness and technical capabilities.

The other is the organization’s ability to keep you cryopreserved for the decades that it will take before you can be repaired and revived. You might be preserved in excellent condition but never see the future because the organization eventually failed. Or the organization survived but cannot afford to revive you. This article examines several aspects of long-term patient care, maintenance, and eventual revival and surveys the various biostasis organizations.

The results of this survey will eventually form part of an overall comparison of biostasis organizations that potential members can use to help them decide, and that existing members can use to decide whether to stay with their current organization or to switch.

Some dire history

Although the cryonics industry has developed in the decades since, we should not forget that of the 17 persons frozen before 1974, only one remains cryopreserved. Depending on who you count, that one – James Bedford – was either the first or second person to be frozen. Uniquely, Bedford was maintained by his son in several locations over two decades. His continued care and maintenance looked unlikely despite Bedford having left $100,000 to cryonics research in his will. That money was more than used up defending both his will and his cryopreservation against hostile relatives.

Just six days after being cryopreserved by the Cryonics Society of California, Bedford was moved to Cryo-Care Equipment Corporation in Phoenix, Arizona. This move undoubtedly saved his preservation. He remained there for two years before being moved to the Galiso facility (a small cryogenics and test equipment manufacturing and repair company) in California. Bedford was moved again in 1973 to Trans Time in Berkeley, California where he stayed until 1977.

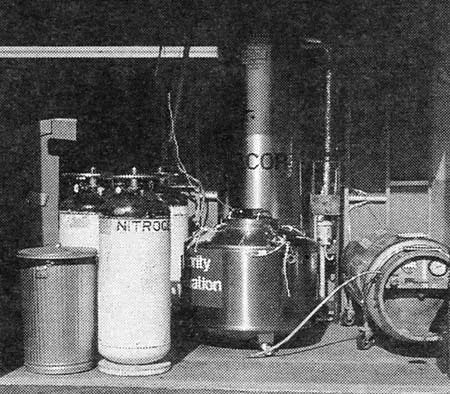

Over the next five years, family maintained Bedford in storage until his care was given over to the Alcor Life Extension Foundation in 1982. Alcor kept Bedford in the back of a small building in Fullerton, California. The photo below shows Bedford’s storage location at Alcor at 4030 N. Palm, Suite #304, Fullerton, California, his home from 14 February, 1982 to 17 February, 1987.

Bedford was moved again on February 17, 1987 to Alcor’s new building in Riverside, California. In September of that year, Bedford’s son Norman made the transfer of care to Alcor legal and irrevocable.

I helped move Bedford to a modern dewar in 1991. Along with a few other patients, Bedford made the trek from California to Arizona later that decade and remains in Scottsdale to this day.

It is tempting to think of ourselves in Bedford’s place. But try putting yourself in the shoes of those who did not make it. In most cases, funding for continued patient maintenance was inadequate. Typically, it relied on relatives to keep paying the bills. With the sole exception of Bedford, relatives gave up, more or less immediately. Relatives might try to abide by the wishes of the cryopreserved but themselves are not committed to cryonics. It is easy to see why they would tire of the payments. As Mike Perry reports in his historical article:

The last suspension failure of this sort was of Samuel Berkowitz, who was frozen in July 1978 and stored at Trans Time’s facility in northern California. I understand that, as the relatives who were funding the suspension (again lacking arrangements themselves) began to lose interest and/or wherewithal, an offer was made to continue the suspension as a neuro (head-only) free of charge, but it was turned down. Instead in October 1983 they had Berkowitz thawed, submerged in formaldehyde, and buried that way [27]. No attempt was made specifically to preserve the brain.

No sweat, you might say, after 1974, the number of cryonics failures plummeted. And that was true, at least until the KrioRus debacle. True, setting Russia aside, patient maintenance has gone far better in the last 45 years. Unless you are highly confident that repair and revival will be possible in the near future, we will need this success to continue for decades to come. Perhaps for a century. The longer the time period we consider, the greater the risk of a failure in patient maintenance.

When I was Alcor president (2011-2020), I was frequently aware that I had ultimate responsibility for maintaining the potential lives of the dozens of patients in Alcor’s care. It is a huge responsibility and should never be forgotten. Alcor’s mission statement rightly puts that responsibility in first place. That is why this article is the first in a series comparing the capabilities of biostasis organizations.

Below, we will provide answers from patient storage organizations along with critical commentary. First, let us consider some of the questions you should have in mind.

What are the strongest organizational forms for long-term patient care?

Two aspects of this question stand out. First is the issue of legal and corporate structure. The second is the issue of how patient care funds are handled.

Cryonics involves several aspects – membership, deployment, standby, stabilization, and transport (SST), cryoprotection, long-term maintenance, and finally eventual repair and revival. In some cases, a single organization handles or has handled all aspects. Even if the organization hires external contractors for SST, it remains responsible for their performance. But there is no obvious reason why all these aspects of cryonics must all be controlled and managed by a single organization.

Membership could be managed by a dedicated organization. It could easily be either non-profit or for-profit. The same goes for SST. Currently, the two main SST providers that are distinct from cryonics organizations – Suspended Animation and International Cryomedicine Experts (I.C.E.) – are nominally for-profit organizations. (In practice, SA works at a loss, subsidized by BRLS, our parent organization. There is also the budding Australian SST provider, CryoPath.)

For patient storage, a non-profit structure makes the most sense. The simple fact is that most of the most enduring organizations around the world have been non-profits. These include universities and religious organizations but also inns and financial companies. The exceptions are the unusually relatively large number of family-owned Japanese businesses. They even have a term for them – the shinise. Shinise are long-lived companies that have survived for more than a century, retained ownership within the same family, and in the same trade for the duration.

When I investigated the topic of organizational longevity for a two-part article in 2020, I found a Bank of Korea report that found 5,586 companies older than 200 years across 41 countries, 565 of which were in Japan. Out of businesses over 1,000 years old, 8 out of 14 are Japanese. We might ask the question: How can we build cryo-shinise? I answered that question in my 2020 piece. The main points to remember here are that most very long-lived organizations have been either non-profit or family-run or both.

The Japanese outlier may fade away. As the population shrinks, families shrink as well. Time will tell whether exceptional longevity can be maintained in a shrinking (and largely closed) society. One clear sign of the challenge lies in the fact that more than 1.2 million small businesses have owners aged above 70 with no successor.

Outside Japan, banks and trust companies sometimes show good longevity. This seems to be a relevant model for long-term care of patients and their funds. As I detailed in the first part of my organizational longevity article, practically all of these enduring financial organization are family based. For instance, the private bank C. Hoare & Co. is the world’s fifth oldest, founded in 1672. It is family-owned and is now managed by the 11th generation of Hoare’s direct descendants. The Board includes seven shareholding Partners, all descendants of the bank's founder. When there are no suitable family members, enduring family companies have adopted competent individuals into their family.

For example, the Metzler family has always held the entire capital of the world’s sixth oldest bank, B. Metzler seel. Sohn & Co. KGaA (founded in 1674). Outsiders have been integrated into the family before being allowed to be responsible for the company. I should also note that while family-based businesses may be good for longevity they are not necessary as good for performance. However, when it comes to long-term patient care, we should be more concerned about durability than performance in terms of generating income.

A family-dominated structure probably doesn’t make sense for biostasis, at least at this point. The closest thing we can see, KrioRus, is/was owned by what was a husband and wife, is a dire warning. A partnership might also be a risky structure. What is needed is a corporate structure – non-profit in the case of long-term care – and an independent board of directors or trustees. Reasonable corporate forms (in the USA) potentially include C-corporations, S corporations, LLCs, cooperatives, and B corporations.

Historical vs. absolute standards

When biostasis organizations got started in the 1960s (all cryonics-based), experience was non-existent and resources were even more severely limited than today. Dismissing all of them as illegitimate because they lacked the personnel, equipment, and procedures common in a major hospital or medical research center seems overly harsh. It just was not feasible to start a new biostasis organization in the 1960s (or 1970s or 1980s) with sophisticated and expensive capabilities. If we absolutely required that, no biostasis organizations could have started.

What about new organizations in the 2020s? On one hand, new organizations may not have the time, experience, or resources to match the best organizational arrangements that have been around for years or decades. On the other hand, new organizations can learn from the long history of biostasis institutions and tap into the greater resources available today.

It seems unfair to judge new organizations lacking high sophistication as harshly as those who have been around for longer. Obviously, it takes time to build up the funds to invest and to set up additional legal and organizational structures. But, while we like to be fair, what we should most be interested in is how likely a biostasis organization is to save our lives. At the very least, we should expect newer organizations to have policies and plans and to follow through on them. Standards should naturally become more demanding over time.

Given that a range of options now exist to get you in biostasis and keep you there, it is reasonable to raise our minimum standards for entry into the field. Nothing like Robert Nelson’s Cryonics Society of California should be accepted or tolerated. Of newer organizations we can require two things at a minimum:

First, higher standards at the start than existed in the past. How much higher is something we can debate. But today’s minimum standards must be higher than those of the past and tomorrow’s minimum standards will be stricter still.

Second, new organizations should add to their reasonable starting conditions solid plans to put in place other desirable features of enduring organizations. For example, there is no good reason to fail to separately account for funds dedicated to patient care from the very start. Plans should be in place to develop independent trust funds even if resources to create such things are not currently available.

A healthy tension exists and should be fostered between ideal standards and what is currently feasible and of sufficiently high priority. For example, no biostasis organization (to my knowledge) has any solid plans for relocating patients in case the existing storage location becomes untenable for legal, political, social, or environmental reasons. From the outside, it is easy to critique organizations for failing to make these plans. From an inside perspective, this issue may seem too low a priority today given everything else demanding attention.

Perhaps it does not much matter whether we favor absolute or historical standards. With a good comparative analysis of organizations published and maintained, individuals can make their own choices. While some people may prefer cheapness or convenience over quality and reliability, the available of solid comparative data should encourage higher standards over time.

Questions posed to biostasis organizations

Here are the questions I have posed to the organizations. In what follows, I summarize the responses received.

Does your organization separately account for money used to maintain patients in cryopreservation and for eventual repair and revival?

Does your organization have a legally separate fund* for money used to maintain patients in cryopreservation and for eventual repair and revival? If not, do you have plans for such a fund? If not, how are funds for this purpose protected? If yes, what information on this is publicly available?

If you have a separate organization for managing patient care, what kind of corporate structure does it use? Who manages it? If elected, how are they elected?

How much money goes into the fund for each patient? If there are different types of patient, please give the amount for each.

How much is in the fund?

How is it invested currently?

What is the investment policy?

Who decides on the investments? How often?

How can potential members of your organization verify answers to the above questions?

Do you have anything to add about your organization’s management of patient care funds?

* This means not just maintaining a separate account on the books but a legally distinct structure – with its own corporate form and distinct board of directors or trustees.

Answers to these questions may or may not come with explanation. A good answer to question 7 would convey not only the what but the why. If all funds are invested in cash, money market funds, and CDs, what is the rationale? Does this strategy allow for inflation? Or negative interest rates? If a large portion of funds are invested in stocks, how much risk is taken and how is it managed? Digging into detail on these and related questions would be a good topic for a future article, although it may be difficult to get organizations to be fully open about their strategies.

Here is an important question not included above: Does an organization set aside funds – even just in an accounting sense – for revival? If so, how are these divided between brain-only, cephalic, and whole body?

It is crucial to make some allowance for projected revival costs. Otherwise, you are making the heroic assumption that people in the future will revive us out of their goodness, and/or that resources and capabilities will be so vast that the task of repair, revival, rehabilitation, and reintegration will be trivial and cheap. Even if that turns out to be true at some point in the future, you may have to wait much longer to be revived. That means more changes to adapt to, and the greater odds of being forgotten about or no longer sufficiently important to anyone.

To some recipients, I posed two additional questions:

What plans, if any, does your organization have to relocate patients in case of local problems (regulatory, environmental)?

If your organization has to cease operations, what plans do you have to move patients to another organization?

These seem to be beyond the planning horizons of today’s organizations. No one has provided useful answers to those questions so I will not discuss them further here.

Responses from biostasis organizations

I sent the above questions to:

The Alcor Life Extension Foundation (USA)

Cryonics Institute (USA)

Tomorrow Biostasis and the European Biostasis Foundation (Switzerland and Germany)

Oregon Brain Preservation (USA)

Southern Cryonics (Australia)

American Cryonics Society (USA)

TransTime (USA)

Yinfeng (China)

The Neural Archives Foundation (Australia)

Osiris (USA)

At the time of writing, all organizations have responded except for the Cryonics Institute (except to say that they had been busy) and the American Cryonics Society. The response from Osiris was limited to this: “We will provide the answers and information only for our members and prospective members.” We did not include KrioRus (Russia).

Some responses are quite informative. For those, I quote extensively or in full. Where responses are skipped or lack substantial information, I will comment but will do my best to stick to known facts and minimize editorializing. To the extent that I editorialize, I will be clear that I am judging by my own standards. Others may be willing to trade off more quality and probability of success for cost.

In what order to present the responses from the organizations? By richness of response? By geographical location (with the USA having the most people with biostasis arrangements)? By founding date of organization? By overall quality of responses? It is easy for me to over analyze. So, I am just going to go with an intuitive combination of completeness of response, organization size, and organization age.

Alcor Life Extension Foundation

Disclosure: I have been a cryopreservation member of Alcor since 1986 and served as Alcor’s President and CEO from 2011 to 2020. This is reasonable grounds for thinking me biased toward Alcor. I was also removed from my position rather abruptly and unceremoniously and have critical views on Alcor’s recent and current trends. In my mind, these balance out so that I can take an objective view.

Responses to my questions were provided promptly by Stephen Bridge, apparently in consultation with Alcor’s leadership. Steve is the architect of Alcor’s Patient Care Trust and the more recent replacement, the Alcor Care Trust. No one could provide a more authoritative response. The answers to my questions were sufficiently complete that I can report them here without interpretation:

Does your organization separately account for money used to maintain patients in cryopreservation and for eventual repair and revival?

A: Yes. Alcor was the first cryonics organization to place long-term funds for Patient Care and for eventual repair and revival into a legal instrument separate from funds for ongoing operations by developing the Alcor Patient Care Trust (PCT) in 1997. In 2016, Alcor created a second trust as a separate organization. The vast bulk of the funds for this purpose are now kept in this legally separate Type 2 Supporting Organization, so those funds are kept fully protected from any legal liability against Alcor. This organization, the Alcor Care Trust Supporting Organization (ACT), is overseen by five Trustees, all of whom must be Alcor cryopreservation members and three of whom must be members of the Alcor Board of Directors. Within this Trust, however, we do not keep funds in accounts which are separated for each patient.

Does your organization have a legally separate fund for money used to maintain patients in cryopreservation and for eventual repair and revival? If not, do you have plans for such a fund? If not, how are funds for this purpose protected? If yes, what information on this is publicly available?

A: Yes. These funds are protected by two legal trusts. Money for cryopreservations is first received by Alcor. The portion designated for long-term care of Patients is then transferred to the Alcor Patient Care Trust. The PCT uses those funds to pay the Patient Care bills (liquid nitrogen, patient containers, a portion of the salaries for those Alcor staff primarily responsible for Patient Care, etc.). Whenever the amount of funds in the PCT are more than the predicted amount of funds needed for current Patient Care expenses, the excess is transferred to the Alcor Care Trust for long-term investment. This is done at least once per year.

The holdings for both Trusts are held by Morgan Stanley Wealth Management.

If you have a separate organization for managing patient care, what kind of corporate structure does it use? Who manages it? If elected, how are they elected?

A: There are two Trusts that manage the funds for Patient Care. Alcor manages the actual physical care of the Patients.

The Alcor Patient Care Trust is legally under Alcor’s non-profit 501(c)(3) designation. It is managed by a Trust Board of five Alcor members, elected by Alcor’s Board of Directors.

The Alcor Care Trust Supporting Organization is a separate 501(c)(3) entity, organized as a Type 2 Supporting Organization, created to support the Alcor Life Extension Foundation. This Trust is managed by a Trust Board of five Alcor members. The IRS requirements for a Supporting Organization include that the majority of the Trustees must also be Directors of the Supported Organization (Alcor), and that the Trustees are elected by the current Trustees.

Further information on the management structure and the requirements for Trustees is available on Alcor’s website.

https://www.alcor.org/library/the-alcor-patient-care-trusts/

How much money goes into the fund for each patient? If there are different types of patient, please give the amount for each.

A: Funds transferred to the PCT/ACT are $135,000 (increased to this amount beginning 2024; previously $115,000) for whole body patients and $25,000 for neuropatients. Some members have provided for extra funding to be placed in the Patient Trusts.

How much is in the fund?

A: As of September 30, 2023, the Patient Care Trust had $510,230.

As of the same date, The Alcor Care Trust Supporting Organization had $18,345,598.

How is it invested currently?

A: “The Alcor Care Trust Supporting Organization invests in a combination of cash, diversified certificates of deposit, U.S. government securities, and U.S. equity instruments with annual rebalancing to generate returns similar to a balanced stocks, bonds, and commodities index portfolio without exposing the entire portfolio to market risk.” (quoted from https://www.alcor.org/library/the-alcor-patient-care-trusts/#assets)

What is the investment policy?

A: See the answer above. This is a long-term policy. The precise investments are based on proprietary methods and are not made public.

Who decides on the investments? How often?

A: The general strategy is decided by the ACT Trustees in quarterly meetings.

The intent is to create a long-term general strategy that will not change over several years. The annual rebalancing is handled by a Trustee designated as the Trust Investment Allocation Manager.

How can potential members of your organization verify answers to the above questions?

A: https://www.alcor.org/library/the-alcor-patient-care-trusts/

Do you have anything to add about your organization’s management of patient care funds?

A: Alcor has provided for the long-term care and potential revival of its patients by funds segregated in trusts for more than 25 years. One of the principal reasons that cryopreservations at Alcor are expensive is because Alcor collects the funds needed for long-term care at the time of cryopreservation, as part of required member funding. Securing those funds in trusts upon receipt further protects them from potential creditors of Alcor’s operational activities and assures that they are managed by fiduciaries motivated by the best interest of the patients. Alcor also conducts periodic reviews to ensure that the expenses of the PCT on account of patient care are consistent with the contributions to the PCT and adjusts those contributions as needed, as indicated by the 2024 increase in whole body minimums, all of which is allocated to the PCT. Alcor conducts a professional accounting review annually and a full audit every three years, each of which includes all of the organizations connected with Alcor, including these two trusts for patient care.

Cryonics Institute

Cryonics Institute, founded in 1976, is one of the two largest biostasis organizations and the third oldest. The organization is incorporated as a nonprofit entity with the State of Michigan. However, for federal and state tax purposes it is taxed as a C Corporation and pays taxes on its income.

The cryopreservation fee at CI does not include standby, stabilization, and transport and excludes some other fees. The cryopreservation fee is $35,000 for yearly members or $28,000 for lifetime members. CI’s president says that CI “has successfully retained” $28,000 per patient for storage and revival. He also confirmed that CI does not have a separate organization nor a separate fund for patient maintenance and revival. Funds are not separated from funds for daily operations.

On the CI website, there are no financial statements for 2020 or 2021 but for 2022 there is what appears to be the first audited financial statements. Based on the Statement of Financial Position, separate accounting of patients funds is in evidence, with a 12/31/22 balance of $9,479,755 for “Investments – Patient Care”. According to CI’s president, “$7 is currently available for storage and revival.” Since patients funds are not maintained separately, that amount could be reduced by any unusual operations expenses (a need to relocate, legal expenses, etc.) “The funds are primarily equities, heavily weighted to no load or low load index funds. Approximately 20% of the investment pool is in a managed portfolio.”

Investment decisions are made by a committee primarily made up of financial and investment professionals who are volunteer members of CI but investment decisions are made by CI’s board of directors. According to the Statement of Activities, for the year ended 12/31/22, “Investment income-net” was negative $1,273,133. CI says that its funds for patient care have grown over time.

Tomorrow Biostasis/European Biostasis Foundation (EBF)

These two organizations are closely connected. Tomorrow Biostasis handles membership, daily operations, and standby, stabilization, and transport (SST), while EBF handles patient maintenance. EBF is a non-profit, tax-exempt foundation in Switzerland. The following information concerns EBF.

Q: Does your organization separately account for money used to maintain patients in cryopreservation and for eventual repair and revival?

Yes, patient funds are separate from all other funds.

Q: Does your organization have a legally separate fund for money used to maintain patients in cryopreservation and for eventual repair and revival? If not, do you have plans for such a fund? If not, how are funds for this purpose protected? If yes, what information on this is publicly available?

Yes, it's separated. Our structure works a bit different than that of other organizations. All contracts, public outreach, day to day operations, SST responsibilities etc. is done by Tomorrow Bio. This includes salaried employees, risk, financial responsibilities as well. So EBF already acts as that separate structure. To offer even further protection of patients, we will announce a third layer of separation soon with an additional long list of rules for board members, after a recent very positive tax ruling that we have gotten. This includes: Mandatory extensive background check, Cryopreservation contract for a minimum of 3 year prior, no financial or personal interests, written obligation to keep up to date with technology, minimum of 3 years professional activity in the field of cryopreservation prior (having a contract is not sufficient) etc.

Q: If you have a separate organization for managing patient care, what kind of corporate structure does it use? Who manages it? If elected, how are they elected?

Foundation, self-perpetuating board, additional layer will also be a foundation with additional board rules (see above). [Note: After this essay was first published, Tomorrow Biostasis created a distinct legal entity, the Biostasis Patient Foundation. Having reviewed the Statutes, I can say that BPF works similarly to the Alcor Care Trust.]

Q: How much money goes into the fund for each patient? If there are different types of patient, please give the amount for each.

EUR 120k (≈131k USD) for whole body

EUR 15k (≈16k USD) for brain (prior 10k, now changed to 15k)

Q: How much is in the fund?

Patient data incl reports are released annually, first time for 2023. All patients in storage are fully funded. Exclusively direct cost is paid out of the return of these funds. EBF non-patient funds can sustain all direct costs until the return form Patient-funds can cover the direct costs.

Q: How is it invested currently?

Bonds and interest bearing fixed deposits. Once interest rates go down and/or inflation goes up in Switzerland we will switch to a different mix (low risk investments).

Q: What is the investment policy?

(Very) low risk, with a minimum ROI goal of 1-2% above inflation. Long-term slightly lower. Please note that Switzerland historically has significantly lower inflation than other countries (incl recently, during Covid, it pretty much did not have any inflation increase).

Q: Who decides on the investments? How often?

The board, annual confirmation of investments

Q: How can potential members of your organization verify answers to the above questions?

We publish audited statements annually

Q: Do you have anything to add about your organization’s management of patient care funds.

We use a different mixing and matching (of organizational functions such as SST from patient care) to separate risky and low risk activities. See above.

NOTE: Reports and audits here: https://ebf.foundation/reports/

Audited statement: EBF published audited statements every year, but they don’t include any of the patient funds yet of course (there were no patients in 2022). We do audits of our annual accounts every year with a certified auditor.

Organizational structure and rules detailed here:

https://ebf.foundation/regulations/

Also see:

https://ebf.foundation/focus-and-outreach/

The tax exemption status can be confirmed here: https://www.zefix.ch/en/search/entity/list/firm/1395286.

Oregon Brain Preservation (OBF)

Jordan Sparks provided answers for OBF (until recently known as Oregon Cryonics). Oregon Cryonics was established in 2005 as a Non-Profit Mutual Benefit corporation. It is not a charitable, public benefit, or tax exempt organization. Organizational information here.

OBF still offers cryopreservation: 15,000 Cryopreservation of the entire head. $5,000 Cryopreservation of the brain only. However, the name change reflects a change of emphasis toward chemical preservation and is “rarely done” according to the website. The cost for chemical preservation is $1000 for chemical preservation. It is important to note that interested parties would have to arrange to get their brains to Oregon as there is no provision for bringing patients in from other locations. No standby, stabilization, or transport services are offered. It is unclear how feasible it is for anyone not living in Oregon to take advantage of OBF’s offering.

Answers to all ten questions were either “no”, “not applicable", or $0 (for questions 4 and 5). “Since the service is essentially free, we do not need to handle large amounts of money and we don't need safeguards for those funds. So, with that context, most of your questions just don't apply to us.” In other words, there are no patient care funds, so no investment strategy or separation of accounting or organization.

American Cryonics Society (ACS)

No response was received from ACS, a California non-profit corporation. To the extent that ACS is still an operating concern, it is the oldest biostasis organization, having been founded in 1969 (originally as the Bay Area Cryonics Society). ACS does not disclose the number of members or patients they have. Most patients are stored in Michigan with the Cryonics Institute, although ACS charges considerably more than CI. Although I have no information on how much money is reserved for long-term patient care, the idea seems to be that the additional charge would enable ACS to move patients to a different location should there be a problem with storage at CI.

Trans Time

Information was provided by Steve Garan, Chief Technology Officer. Trans Time says that it offers standby, cool down, transport, cryoprotective perfusion, and storage. The website is: https://www.transtime.com/index.html

The answers to the questions provides little specific information. Funds for patient care and eventual revival are separately accounted for but not in a legally separate entity. No specifics were given as to the investment approach: “We have funds that are invested. The income from the investments pays for the expenses that are related to patient care, i.e. LN2, Utilities, etc.” Only full body patients are stored but no amount was specified per patient. In response to questions 5 and 6 about the amount currently invested and how funds are invested, the response was” “NDA required.” In response to question about investment policy, the response was: “investment policy is low risk and that endeavours to maximize on yield.” Investments are decided by the “CFO, CEO and the Board of Directors are involved in investment decisions”.

In response to question 9, “How can potential members of your organization verify answers to the above questions?” the reply said that a membership program is a barrier to the public but did not address the core question of verification.

Southern Cryonics

Peter Tsolakides provided a prompt response to my questions on behalf of Australia’s Southern Cryonics (the trading name for Stasis Systems Australia Ltd.). In terms of patient storage, Southern Cryonics is very new, having become fully operational in February 2023 – although years of work are behind this opening. For some history, SC’s website is: https://southerncryonics.com/

Q. Does your organization separately account for money used to maintain patients in cryopreservation and for eventual repair and revival?

A. No, we don't at this time but we may consider it in the future. Also, at this stage we do not have any patients.

Q. Does your organization have a legally separate fund** for money used to maintain patients in cryopreservation and for eventual repair and revival? If not, do you have plans for such a fund? If not, how are funds for this purpose protected? If yes, what information on this is publicly available?

A. Again we do not have one, but as we evolve we will consider it closely.

For questions 3 through 7, see the comments below.

Q. Who decides on the investments? How often?

A. At this stage the board of SC. The key principle is to be prudent.

Q. How can potential members of your organization verify answers to the above questions?

A. Since there is no separation of the funds we can easily verify. Like most of the cryonics organization we are a non-profit so we are very open as to how we do things and all this is open to members/subscribers or those requesting the information.

Peter Tsolakides provided additional information that addresses some of the questions:

SCs only handles whole body patients. The fee is Aust$150,000 but that does not include SST. “Another completely separate corporate entity, CryoPath, does the SST and that is on a pay-as-you-go basis at the time of the suspension.” All funds are pooled and there is currently no separate fund for patient care. However, SC assumes that about $100,000 is for patient storage/care and revival. “We assume we can obtain a return of 3% above the inflation rate over the very long term (e.g. secure index funds). At the moment all our funds are in bank deposits because we are still in the early stages and need flexibility with our funding. As we develop and stabilize we will shift to these secure index funds or similar.” Peter notes that: “For reference, historically over the long term, these secure index funds have returned about 5% above the inflation rate in Australia so the 3% is a reasonable assumption.” It should be noted that this average includes periods well above or below the trend and this can affect the sustainable withdrawal rate.

“This 3% return above inflation is enough to cover average yearly long term storage care. This means, at the time of revival we should have a real $100,000 for each of these patients. i.e. $100,000 in today's dollars.” If the assumptions are accurate and investment proceeds according to this policy, much more than the (real) $100,000 should be available in the future. A 3% real return means that available funds will double every 24 years. “Should the cost be more than this, the patient can supplement through a separate long term Trust set up while alive (we offer these through a separate trust organization called CryoPrime).”

Neural Archives Foundation

Founded by Philip Rhoades and James Newton-Thomas in 2008, Neural Archives Foundation (NAF) is an Australian non-profit organization which preserves neural (brain) tissue as an historical archive and supports research into brain and neural disease states. Website.

“The NAF is a registered charity with the Australian Charities and Not-for-profits Commission (ACNC) and is endorsed as a Deductible Gift Recipient (DGR) with the Australian Tax Office (ATO) from 23 February 2018. The donor tissue is stored in cryogenic tissue banking facilities at liquid nitrogen temperatures…”

https://www.acnc.gov.au/charity/charities/d6f59aad-3aaf-e811-a962-000d3ad24a0d/profile

The most recent financial report appears to be for 2020.

“The minimum donation required to cover our costs is presently AUS$30,000 which is enough to store the tissue indefinitely. There are some additional costs (usually totaling less than AUS$4,000) for associated services related to the actual neural tissue extraction and processing.”

“The NAF is “marketed” as an information preservation organization i.e. like creating “time capsules” of the memories of individual human (and a few dog) lives - however, I am sure that any of preserved consciousnesses would be happy to be re-instantiated in a new biological, synthetic or virtual body - if that ever becomes possible - so there is certainly a somewhat similar thinking going on as there is for Cryonics preservations.”

Six directors oversee the organization. There is no separate organization for patient care and maintenance. According to PR, the sole bank account with funds in it is “dedicated to paying for storage costs.” From the 2020 financial statement, the balance of the “Transaction Account” on June 30, 2020 was $32,877. Between $10,000 and $30,000 is provided per person. The funds are invested in “interest bearing accounts” that are “low-interest, safe investments”. Investments are managed by Philip Rhoades. Serious potential members can contact Mr. Rhoades for verification of this information and with any further questions.

Yinfeng Life Sciences Institute (Yinfeng Bio)

Yinfeng Life Sciences Institute is a subsidiary of the Shandong Yinfeng Investment Group Co., Ltd. This top-level organization has four divisions: Banking and finance, corporate real estate development, real estate management, and biotech. The biotech division (Yinfeng Biological Group, Ltd) consists of eight subdivisions including Yinfeng Cryomedicine Technology Co, Ltd and the Shandong Yinfeng Life Sciences Institute. The latter is usually referred to as “Yinfeng Bio.” The cryonics division is not a standalone corporate entity in the sense familiar to us from other biostasis organizations.

Yinfeng Bio have 16 whole body patients. The price for cryopreservation depends on what other Yinfeng Bio services the individual has subscribed to (such as stem cell storage, pre-birth genetic testing, and precision cancer treatments). Without any other services, the standard cost is around $375,000 USD. For foreigners, the fee is around $250,000 USD. However, Yinfeng would be unable to respond outside China and so arrangements with an outside SST provider would be required. Yinfeng has plans to expand throughout Asia by developing partners in countries including India, Japan, Malaysia, Singapore, and Philippines.

We do not have any information about separate account or a distinct organization for handling patient care funds. Particularly concerning is that the cryopreservation contract stipulates a period for storage of only 20 years – the same length of time for storage of cord blood stem cells. Yinfeng says that they would not dispose of cryopreserved bodies after 20 years. However, there is no contractual guarantee of this. Acting on the stated commitment will require benign neglect from the government or a change in rules before 20 years has passed.

Our thanks to Aaron Drake for this information.

Osiris

Response from owner Dvir Derhy. Osiris started in 2016. It is a for-profit LLC corporation with no board of directors.

Pricing has gone down drastically from $300,000 to $28,000. It is not clear what portion of any amount goes to patient care, if any. Osiris does not seem to have a patient care trust fund. I was unable to find any information regarding how many patients they have, how many members, nor information regarding investors or medical professionals involved with them. I found no evidence of separate accounting for patient care, nor of a separate organization, and no clues as to investment policy, if any.

Mr. Derhy Would not answer any of the ten questions. “We will provide the answers and information only for our members and prospective members.”

Comparisons and comments

This article provides a snapshot of the structural and financial aspects of patient care across the existing biostasis organizations. As organizations grow, policies change, and new organizations arise we plan to either update this article or summarize the changes in a related piece.

Unfortunately, not all organizations responded and some responses were thinner than desirable. We have made every effort to present information accurately based on responses and on publicly available information. If you are an official of an organization and find any errors, please contact us.

Accounting and legal protection

In terms of patient care management and financial planning and protection, Alcor has been the leader for years. It is not easy to set up a legally separate trust to manage funds for patient care (and eventual revival) but it is highly valuable to do the work. The model pioneered by Alcor is worthy of emulation. Tomorrow Biostasis (TB) and the storage organization European Biostasis Foundation (EBF) are taking steps to do so, and Southern Cryonics indicates that it plans to move in this direction.

While relatively new, TB and EBF have already adopted sophisticated methods for handling long-term patient care and financing. As noted in the response above, new developments will be announced in the first quarter of 2024. The ability to start with high standards was enabled by the founders’ success in initial fundraising but would not have happened without determination and perseverance.

Although Southern Cryonics is extremely new in terms of being operational, it appears to be well planned out for patient care funding. With no patients, it may be unreasonable to demand a separate fund and a legally distinct organization to manage patient funds. However, as SC grows and acquires patients, we would urge the organization to adopt these structures. Ideally, separate accounting should begin with the first receipt of patient funds, and a distinct structure for managing the funds should be created as soon as financially feasible.

Funds per patient

Since costs vary across organizations, it is not easy or simple to compare them in terms of funding adequacy without a deep dive into the finances of each.

Alcor, EBF, and SC have fairly similar amounts for each patient. NAF appears to set aside almost all income for storage, which is done by various locations around Australia. CI allocates considerably less but may have lower costs. CI and perhaps other organizations may also be assuming that future gifts will grow patient care funding and so set their patient allocations lower than actual costs. For instance, it is known that CI’s main facility (where patients are stored) was paid for through a bequest. Alcor’s Patient Care Trust Fund has also benefited from large infusions of money, including a multi-million dollar bequest. In so far as large gifts are made, the need to draw on a patient care fund is reduced.

OBP sets aside no funding for long-care maintenance; ACS and Osiris will not disclose numbers The lack of funding for long-term care and for eventual revival means that clients must rely entirely on unknown people in the future to repair, re-embody, revive, and rehabilitate them.

Investment policy

If patient care funds are kept in an account separate from that for operations, research, and so on, they should be invested with two goals in mind: (a) To produce sufficient return to cover expenses indefinitely with funds still available decades from now to pay for repair and revival; and (b) control with risk sufficiently that fluctuations in returns will not crash the fund. On the second point, what seems like a perfectly adequate long-term rate of return can cause a fund to crash if it experiences too much volatility. A few bad years of negative return may make it impossible to cover expenses. This is the same reason retirement planning advisors have urged retirees to avoid drawing more than 4% per year.

Alcor’s approach is to draw no more than 2% draw annually (with some ability to gradually adjust up or down depending on investment returns). EBF and SC appear to be using a similar approach although no maximum annual draw was mentioned.

Little information on investment policies are available from most organizations; the exceptions being Alcor, EBF, and Southern Cryonics. Specific details of an organization’s investment policy may be withheld for competitive reasons or perhaps because the policy depends on not being known and followed by others.

Neither Trans Time nor Osiris provide any investment information and both explicitly state they will not provide the information. Southern Cryonics provided financial and investment information and we hope they will also publish financial statements as operations get up to speed.

Verifying answers

In the case of most organizations, not all the information provided here can be found on their websites. Only Alcor, EBF, and OBP make their corporate documents readily available and also put financial statements online, as do CI and OBP.

Osiris in particular displays a complete lack of openness about organizational details, financing, and investment approach. This should give potential clients pause, to say the least. Perhaps those who present themselves as serious prospects can get some answers although those will not be especially credible if the answers cannot be discussed publicly.

A note on Russia: We have not attempted to include KrioRus. The recent, highly disruptive events and movement of patients make this an unstable situation. A recent offshoot or alternative to KrioRus – Open Cryonics – has recently formed. We will monitor the situation and perhaps include the Russian organizations at some time in the future.

Comparing cryo to chemo approaches, as of now the organizations offering only chemical preservation have very weak patient care protection, maintenance, and revival policies.

Requiring membership or an NDA before providing any information about amounts invested to maintain patients and the nature of the investment strategy strikes us as extremely undesirable.

Organizations should have publicly available accounting, preferably with at least an external review and preferably with audited accounts, especially for organizations holding patient care funds. In our opinion, organizations that require signing an NDA or first becoming a member do not meet minimum requirements for a biostasis organization. How is an individual to make a rational decision about an organization while lacking critical information such as this?

A closely related issue on which we did not press biostasis organizations (for now) is planning for relocation of patients. Organizations that fail to maintain funding sufficient for continued storage and care are not going to be able to afford to relocate patients in case of legal, environmental, or organizational challenges to continued operation. Even with funding in place, it would be good to see concrete plans for relocating patients. This could include agreements between organizations or backup plans with Timeship in Texas. There have been a few examples of patient relocation:

Alcor’s move from California to Arizona.

Move of two patients from CryoCare to Alcor. http://www.cryonet.org/cgi-bin/dsp.cgi?msg=23827

Move of ten patients from TransTime to CI.

We hope to create a comprehensive head-to-head comparison of biostasis organizations informed by this article. You can find something like this created by Ben Best but note that it was last updated in 2018.

Further reading:

“How to Sustain an Organization for Over a Century: Part One: Corporate Longevity”, Cryonics, July 2020

“The Organizational Architecture of Longevity: Cryonics Organizations Built to Last”, Cryonics, November 2020.

“The Problem of Inflation for Cryopreservation Minimums”, Cryonics, September/October 2018.

Interesting analysis! This summer I put this together with help from a virtual assistant:

- https://cryonics.miraheze.org/wiki/List_of_SST_providers

- https://cryonics.miraheze.org/wiki/List_of_preservation_providers

- https://cryonics.miraheze.org/wiki/List_of_long-term_care_providers

It is already out-of-date. This a useful and difficult task and I appreciate you putting in the effort.

Outstanding, balanced, fair-minded and data-driven article by Max More. The distinctions seem pretty straightforward, and are not surprising to those of us who follow and care about the details of Cryopreservation organizations. CI's lack of response is unfortunate, but having attended most of the Fall meetings at CI for the last ten years, the data confirms CI does have solid and sustainable funding. Osirus is a Cryonics PR disaster waiting to happen, and I hope our community can attenuate this before some enterprising reporter decides to expose Osirus.